Portfolio Diversification Strategy

Smart investors are always looking for better ways to balance their portfolios, protect their wealth, and grow their capital. One of the most popular strategies is diversification. If you have been considering investing in precious metals, the chances are this term has come up quite a lot, so let’s take a closer look.

Physical precious metals are just one of the ways people diversify their investments, but to really make the most of the strategy, you need to go beyond just one varied asset. In this comprehensive guide, we cover all the essentials of diverse investing- including the advantages and potential pitfalls, how to assess your portfolio, and various tips for optimizing the strategy for your benefit.

Whether you are trying to understand more about how investing in precious metals benefits a portfolio or you are looking for strategic suggestions moving forward with other asset classes, we have the answers and information you need to get started.

Understanding Portfolio Diversification Strategy

Whatever investments you are interested in, be it the precious metals market or something else, it is vital to understand the meaning of diversification and how to implement it in strategies for investment purposes. Let us kick off this comprehensive guide to diversification strategy by laying out exactly what it means, what it does, how it works, and why it matters.

Defining Portfolio Diversification

In short, portfolio diversification is an investment strategy aimed at managing risk and maximizing return potential through varied investment choices. It works by spreading the total wealth in a portfolio across a broad spectrum of asset classes- rather than focusing on one area alone.

The Role of Diversification in Investment

The part diversification plays in investment strategies is all about protecting a portfolio long-term. If all the eggs are in one basket and that basket breaks, they all get broken. In other words, invest all your money in one sector, and if that sector fails, the funds in said portfolio go with it. By diversifying, you create balance- meaning you can make up for losses in one area with the returns gained elsewhere. A good investment strategy uses diversification to hedge against all risks, leaving as little exposure as possible.

Key Elements of Diversification Strategy

Every diversification strategy should tick the following boxes.

- The portfolio should include assets from different classes- including stocks, commodities (such as gold and other precious metals), exchange-traded funds, real estate, legal tender, and bonds.

- Investments should also be geographically diverse and spread across different industries.

- There should be a reasonable balance between high and low-risk investments- and high and low-return investments.

- Inflation should always be accounted for as part of the plan.

- Diversified portfolios should be regularly assessed and reworked according to market changes and challenges.

Importance of Diversification in Financial Planning

Diversification is important in financial planning because it provides a solid groundwork for reaching long-term financial goals while keeping risk and exposure levels to a minimum. It does not guarantee against losses by any means, but it does create a balanced and reasonably protected portfolio that is overall more likely to succeed.

You can’t plan your future finances based on the performance of one asset right now- the market is just too volatile. However, you can give yourself a better picture of future results when you have varied investment products chosen to balance each other.

To give an example, the US dollar can fluctuate, so there is no guarantee that savings will be worth five years from now given inflation. Gold prices tend to move in the opposite way to the dollar. If you have physical gold in your precious metals portfolio, you have a hedge against whatever happens to the dollar. This is just one example of how diversification helps with financial planning- the full scope is complex and intricate.

Advantages of Portfolio Diversification

Now that we have taken a closer look at what diversification is, let’s discuss its benefits. We already touched on a few, but it is worth stressing just how advantageous it is for investors.

Mitigating Investment Risks

When you have diversified assets, the exposure to negative performance from one asset has less overall impact on a portfolio. This strategy improves risk management and reduces its net effect by cushioning any losses from one asset with the returns from another.

Enhancing Return Potential

Speaking of returns, a well-diversified portfolio has better overall return potential. Various factors go into optimizing return potential, but high-risk investments tend to have high economic value and greater profit potential. It is important to have these in a portfolio, but it is even more important to balance them with more stable assets elsewhere.

Protecting funds with stable investments such as physical metals like gold and silver leaves space to explore higher return assets on the more lucrative stock market. This allows investors to harness the growth potential offered in high-risk markets without exposing their entire portfolio.

Capital Preservation

Price movements, volatility, and inflation are just some of the things that can have negative impacts on a person’s capital over time. Leaving funds sitting for too long without any assessment or diversification is a good way to watch the total value of your capital dwindle.

Instead, invest in assets that preserve wealth over time. Buy precious metals to hedge against inflation, consider cryptocurrency as an alternative to fiat cash, and look into other investments that maintain capital even during market volatility, political developments, and economic uncertainty.

Providing Investment Stability

The whole thing can be summed up in one word: stability. High investment return is one thing; preserving capital is another. Pushing the limits with high-risk investments is not a bad thing- as long as there is a reliable asset to cushion the blow if this goes wrong. Stability and balance are the two key pillars of diversification strategies.

Without stability, it is impossible to plan for your financial future or make informed choices about your wealth. Knowing you have a well-diversified, stable portfolio can provide some level of certainty as you look forward.

Implementing Portfolio Diversification Strategies

How do you put all this into practice? With the help of a financial advisor, you can explore specific investments across the full spectrum of assets that could benefit your portfolio. To get you started, here is an overview of the potential classes you could invest in and the benefits of each.

Diversification Across Different Asset Classes

There are two elements to consider with diversification: between asset classes- and within the asset classes themselves. Let’s start with the different classes.

Equities

Equity investments are also known as stocks- both of which mean shares in a company. Investing in stocks or equities is like buying partial ownership of a company. If the company does well and increases in value, your stock prices go up. On the other hand, if companies fail and lose money, so do you.

The stock market is notoriously volatile, but it is also the place that offers the highest potential returns. Buying equity in a small company just starting out that suddenly does extremely well could see your original investment soar. With great return potential comes great risk- and the nature of the market is inherently risky.

Younger investors are especially interested in stocks- since they offer the possibility to grow capital quickly. Investors who are closer to retirement tend to steer away from this type of investment- as they have less time to recover any significant losses. It is worth having some carefully chosen stock investments in your portfolio. Buy shares in companies you believe in and that pass any relevant criteria you and your financial advisor have. You can trade stocks to maximize the potential- just don’t forget about the possible risks involved.

Bonds

Bonds are also called securities. A security or bond investment is essentially a fixed-term loan where the investor buys debt in return for steady interest and guaranteed (more or less) repayment. The bonds market is actually worth more than the stock market and is an integral part of most people’s portfolios. A bond can be issued by a government entity on a company. They auction the debt to investors, and the ones who buy it (sometimes just one investor, other times it is shared) get the money repaid, with interest, over a fixed term.

They are especially popular for retirement portfolios, as they offer a fixed income of sorts. The risk is much lower than it is with stocks- especially if you go for a Treasury bond. Investment grade bonds are graded on a scale of AAA to BBB (AAA being the highest, then AA, then A, then BBB). Anything lower than that is not considered a high-quality bond, but they are still available to buy for those who have a higher risk tolerance.

Commodities

Commodities are physical products that come from the earth in some way. There are five main ways to invest in commodities: buying stocks in the production companies, purchasing contracts, investing in shares through an exchange-traded fund, trading through index funds or mutual funds, and working with a commodity pool.

In some cases, you can buy the physical products themselves- which is what many precious metals investors do. Precious metal is just one type of commodity investment- you also have products such as oil, crops, industrial metal, livestock, and natural gas.

Real Estate

Real estate is an interesting investment category. It involves purchasing land, property, or certain land-based activities, including agricultural sites and livestock. Depending on the size of a person’s portfolio, they might buy multiple properties to rent through a third party or invest in real estate projects in return for a share of the profits.

The real estate market is not free from volatility, but people will always need places to live and land to work or build on. Smart real estate choices can be lucrative, but it all depends on how hands-on or hands-off you want to be as the owner or investor.

Diversification Within Asset Classes

Next, let’s explore how to diversify within each asset class. It is not just about spreading investments across different classes- you should also consider the variety within each category.

Geographic Diversification

Political developments and international affairs have undeniable impacts on the success of certain investments. Because of this, it is worth spreading your investments across companies with different physical locations. This applies to stocks, bonds, commodities, and real estate.

Diversification Through Alternative Investments

Alternative investments go beyond the usual options with the highest investor demand. This includes diamonds, art collectibles, cryptocurrency, electronics, and industrial products. You should be considering precious metals in diversification as well. You can diversify using these assets- or shares in these assets- across multiple classes. Shares in electronics companies, gold or diamond mining stocks, bonds in the automotive industry, and investments in energy commodities are just some examples.

Regular Portfolio Rebalancing

It is vital to regularly assess and rebalance your portfolio. A solid diversification plan one quarter may not be as effective the next once the economic climate is considered, and investors must be ready to react and rework their strategies. Diversifying within asset classes is a good way to quickly rebalance. Changing one commodity for another or switching shares in one industry for another keeps the portfolio balanced while changing the tactics used.

Key Considerations for Portfolio Diversification

Many agree diversification is vital for long-term investment success, but it is important to always compare options and consider your personal circumstances before making any decision. What works for one person may not be right for another, and it is wise to explore the key considerations before making any definitive moves.

If you are thinking about adopting the diversification strategy for your portfolio, here are a few points to ponder. It is also worth noting that the same considerations should be re-addressed regularly if you do decide to move forward with this type of plan.

Investor’s Risk Tolerance and Investment Horizon

The balance of risk and reward is one of life’s most delicate- especially when it comes to your long-term financial goals. Understanding how much risk is involved in investment- and how much risk you are truly comfortable with- is a vital element in portfolio diversification. At the same time, you need to be aware of what opportunities lie ahead. Keeping one eye on the investment horizon and another on the current risk-reward balance within your portfolio can be tricky- but it is very important.

Focusing on risk tolerance for a moment- investors should understand that this can change. How much risk a person is comfortable with can be as volatile as the markets! Life changes, circumstances change, and priorities change- especially as we age. Checking in on your risk level and how potential future investments would change it is a must for long-term success with this type of strategy.

Current Market Conditions and Industry Trends

A mistake some people make is overlooking and capitalizing on potential high-return assets because they don’t keep up to date with market conditions and trends. Whatever areas you invest in should remain the center of your focus until you sell. Until then, any movement is relevant to you.

The same applies to any assets you are considering. It is worth studying the market’s ongoing trends- as well as past movements and patterns. That way, you are well-prepared for possible outcomes and can react effectively.

Identification of Potential Risks and Threats

Whenever you add a new investment- usually even before you do- you spend time getting to know the market and industry to highlight any events or potential happenings that could present a threat. Diversified portfolios rely on balance, so you must be aware of the potential risks before bringing something into the fold.

Furthermore, you need to keep up with any changes. Markets rarely stay still for very long, and there could be significant changes in short spaces of time. Staying focused, involved, and aware can help you quickly identify possible threats or risks- and give you time to react through your investment decisions.

Understanding Fees and Costs

It is not only the investment’s potential return you need to think about- there are also the initial fees to consider. Most assets involve some sort of cost at the beginning- be it commission to a broker, buyer or seller tax, administrative costs, or transaction fees.

Because diversifying, by nature, requires you to invest in multiple things at the same time from all different sectors and classes- you will have to pay more of these fees. Before you dive head-first into a strategy, explore your options based on the actual cost to you in the beginning.

Assessing Portfolio Diversification

Investments are rarely fixed in one place- values change regularly with the performance of markets and assets. Because of this, it is vital for investors to use the diversification strategy to assess their portfolio regularly. This can get quite complicated- more so for those with a wider selection of assets. Nonetheless, it is an essential part of the strategy that helps monitor movements and plan the next moves.

Various formulas and calculations are used to assess portfolio diversification efficacy and performance. Most people use professional services to manage these elements, but it is still good to know what they are and how they work. Below, we have shared some insight into three of the main calculations and techniques used to assess investments in a diversified portfolio.

Correlation Coefficient Analysis

The technical definition of the correlation coefficient analysis is a way to statistically measure the relationship- and the strength of said relationship- between variables and their relevant movements. In other words, it looks at how two things react to one another. There are three possible outcomes:

- A score of -1 means the variable moves in opposite directions- also known as inverse or negative correlation. When the value of one increases, the other decreases.

- A score of 0 means there is no correlation between the two, and their individual movements have no impact on one another.

- A score of 1 means they move together. When one goes up, so does the other. If one drops, the other does the same.

To an investor, this measurement helps them assess the correlation between the success or failure of particular assets. An example could be gold and silver prices compared to the US dollar- which has a negative correlation score of -1. Historically, when the dollar drops, gold prices increase- and vice versa. It is also used to determine short-term changes in security prices by traders.

Standard Deviation Calculation

Standard deviation calculations are used to assess the volatility of your portfolio and particular assets held within it. It is a three-part calculation:

- The standard deviation of each asset individually

- The weight of said asset against the total portfolio

- The correlation between the two

These calculations are used to determine risks and potential fluctuations. High standard deviation rates usually mean higher risk- but they also may mean more potential for higher returns. On the other hand, portfolios with low standard deviation are less volatile and more stable- but also less likely to have significant return spikes.

Ideal standard deviation depends on the investor’s risk appetite and financial goals. People can use the calculation to decide between investment options and strategies- opting for higher rates if they are willing to risk more in the hope of generating more returns- or lower rates if they prefer stability and predictability.

Portfolio Asset Count/Weighting

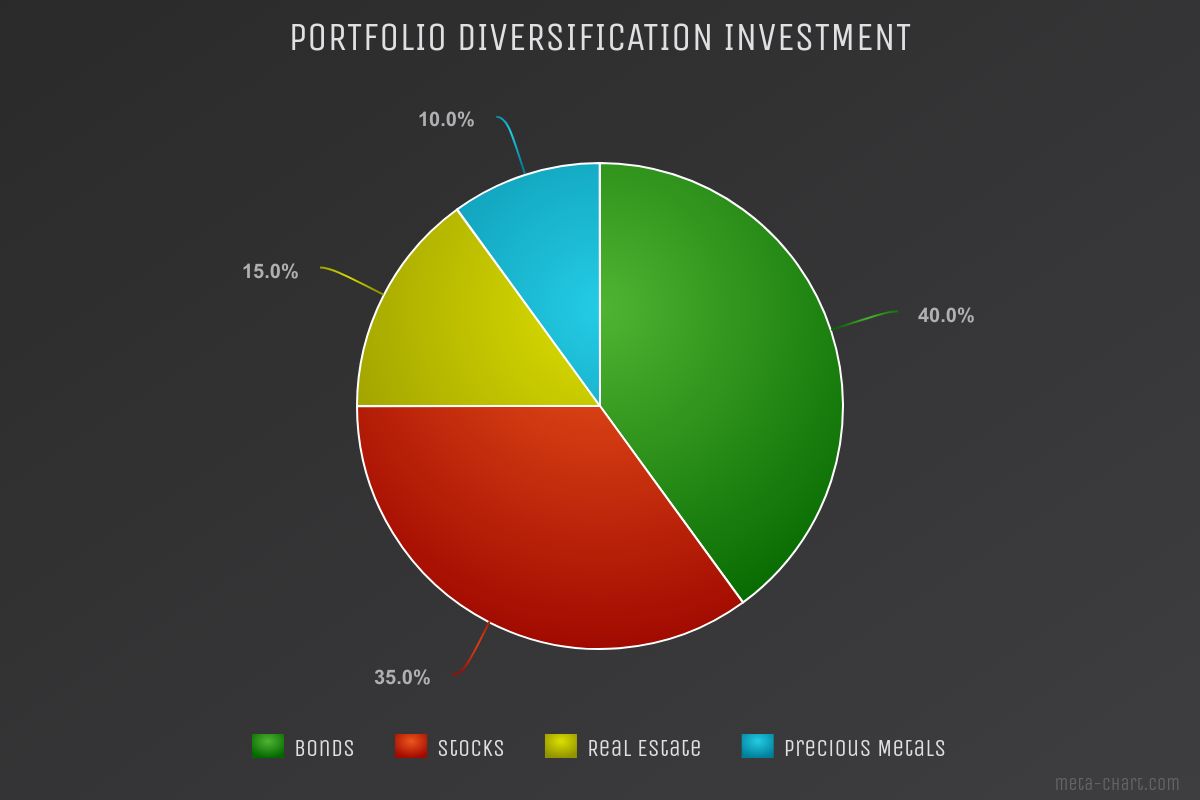

Another tool used to assess diversification is portfolio weight or asset count. In the simplest possible terms, portfolio weight means the percentage of the overall portfolio invested in a particular type of holding- for example, 40% bonds, 35% stocks, 10% precious metals, and 15% real estate. This is a pretty broad example, but it gives you a basic understanding of what the term means.

The weight of a particular asset is calculated by dividing the value of the investment by the total sum of the portfolio. If you have an investment portfolio worth $200,000 and $80,000 of it is invested in bonds, then the weight of your bond investments is 40%.

It is important to re-assess asset counts and weights regularly- especially where stocks and shares are concerned. A stock price can change significantly in a short space of time, ultimately changing the dollar value and its weight against the rest of the portfolio.

Avoiding Pitfalls in Portfolio Diversification

While diversification has many advantages and is widely touted by experts as the most effective investment strategy, it is not without its potential downfalls. The best way to avoid the possible pitfalls of portfolio diversification is to understand what they are. Knowledge, in this case, is the best defense.

Dangers of Over-Diversification

There is a fine line between a well-balanced diverse portfolio and one that is over-diversified. A well-diversified portfolio includes a range of carefully picked investments in different asset classes with different characteristics. An over-diversified portfolio has too many investments- spreading the funds too thinly and diluting the return potential.

You can also over-diversify by choosing too many investments within the same asset class or industry. This complicates account management and makes it harder to keep track of and assess your portfolio.

Importance of Considering Commissions and Hidden Costs

Something people often fail to consider is the cost that comes with diversifying. Every investment carries hidden costs. These include transaction fees, broker commissions, and purchase fees. The more investments you make, the more times you need to pay.

It is vital to consider the additional costs associated with the portfolio diversification strategy- and to weigh the impact they have on your returns. Transaction fees are not generally the first thing people think about when choosing how to invest, but they can add up quickly. Some ways to avoid this pitfall include:

- Comparing fund expense ratios

- Diversifying just enough to reap the benefits, but not so much that you end up over-stretching and over-spending

- Checking commission rates before committing to a broker

- Working with a long-term financial advisor rather than paying for advisory services every time

- Assessing the overall costs of each investment and working potential reductions into future adjustments

- Sticking to a structured plan rather than investing randomly with little preparation

Regular Portfolio Review and Rebalancing

The best way to avoid falling into any of the possible issues relating to portfolio diversification is to regularly assess, review, and rebalance the investments. Underestimating the importance of this task is in itself one of the major mistakes people make when using this strategy.

Because there are numerous assets in play at any given time, the effort and organization needed to properly take stock of current standings seems like too much work. However, failure to do so can- and does- result in a loss of direction, poorly performing investments, and straying from the investment goals and diversification target.

Rebalancing is easier when the investor has a clear thesis- including their risk tolerance and return target. You also need a good understanding of how your diversified assets interact with each other to know where adjustments should be made.

Perspectives on Portfolio Diversification

Now that we have looked in detail at the ins and outs of portfolio diversification and how it works, let’s consider the various perspectives on the strategy and its uses. We will look at things from the view of an investor, a financial advisor, a market analyst, and an economist to cover the full spectrum of diversification strategy and its impact on portfolio investing.

Investor’s Perspective

As an investor, the primary goal (in most cases) is to protect wealth and build capital through select investments. Some people find diversification daunting- given the amount of work that goes into balancing, assessing, adjusting, and managing the full scope of the portfolio. That said, the positive impact it has on risk management overall cannot be ignored.

From the investor’s perspective, diversification offers a way to reduce risk without detracting too much from return potential. Get the balance right, and there is an opportunity to see substantial growth over time without excessive exposure to volatility. In the eyes of an investor, this is certainly a positive. On the other hand, they must also consider the downsides. Higher costs, more complex management requirements, and potentially lower returns overall are some of the possible drawbacks- so it all depends on a person’s individual goals.

Investors working with a retirement account portfolio are generally more favorable to this type of strategy, as it tends to offer more stability and reliability. People at this stage are usually more concerned with protecting the wealth they have built and growing it safely than risking irreplaceable funds in the hope a risky investment pays off.

Financial Advisor’s Perspective

Most financial advisors recommend at least some level of diversification in any portfolio. Very few people deny the risk-reducing benefits, and it is smart investing in the eyes of most investors. Where things vary is the extent to which they recommend clients diversify their assets.

Financial advisors work for the investor. They advise based on what the portfolio’s owner wants to achieve and is comfortable with. In this sense, their perspective is less important- but there is a reason this position exists. From their perspective, they look at strategies that can best help an investor achieve their financial goals. In most cases, that will involve some level of stability and protection- which can be found through diversification.

Market Analyst’s Perspective

A market analyst is someone who assesses the performance of a specific marketplace- or multiple markets- based on the conditions and factors that may affect it. As such, they have a unique perspective on investment opportunities and how to make the most of them.

In some cases, a market analyst may take a different stance on portfolio diversification based on current conditions. A particular asset may be poised for high-return potential- in which case a market analyst would view it as a good opportunity. However, that same investment may not fit well into a diversified portfolio when we apply the assessment metrics.

This is one of the potential pitfalls of portfolio diversification. People can fall into the trap of ignoring opportunities that do not fall within their strategy. There are two sides to this. On one hand, it is generally advisable to stick to the investment thesis. Conversely, should people miss out on an investment that analysts favor because it doesn’t fit the formula? It is certainly a point worth discussing with a financial advisor- especially if you consider the market analyst’s perspective.

Economist’s Perspective

Economists study the bigger picture of national and international economic climate and its impact on specific markets. This includes interest rates, tax laws, geopolitical temperatures, and trade agreements. By doing so, they can predict future trends in particular asset classes. The primary role of an economist is to help businesses and individuals prepare for and react to economic changes that may impact them and their finances. In this respect, they are valuable voices for anyone with a diversified portfolio.

An economist’s perspective on portfolio diversification focuses on the predicted future results of an investment based on the economy and its movements. It can help people make big decisions when assessing their investment choices and rebalancing their portfolios.

Frequently Asked Questions

What are the benefits of portfolio diversification?

Diversifying a portfolio using investments such as physical precious metals benefits you in several ways. It increases the ability to manage and mitigate risks, offers increased stability in times of economic uncertainty, minimizes the impact of price volatility in the market, and helps to harness growth potential long term.

How can I achieve diversification in my investment portfolio?

The best way to diversify is to invest in a range of assets and asset classes with different characteristics. That way, you have reduced exposure to volatile market conditions and gain exposure to more growth potential. Many people invest in precious metals or the precious metals sector specifically for diversification purposes. Rare metals such as gold are particularly beneficial because they act as a hedge against inflation in the US dollar.

What are the common mistakes to avoid in portfolio diversification?

Some of the biggest mistakes people make when diversifying their portfolios include:

- Ignoring other important factors in favor of diversification

- Failing to diversify the asset classes- not just the assets themselves

- Worrying too much about short-term volatility

- Forgetting to work inflation into their long-term investment plan

- Leaving their portfolios unmonitored and unadjusted as time goes by

All these things can lead to over-diversification, lost opportunities, and ineffective long-term investments.

How can I measure the level of diversification in my portfolio?

Exact mathematical methods for calculating portfolio diversification methods are complex- which is why software exists to figure it out for you. A financial advisor or investments manager usually deals with these calculations.

Can I over-diversify my portfolio?

Yes, you can. Having too many investments across too many asset classes can be just as bad as having too few. It can dilute potential returns, complicate portfolio management, and lead to ineffective investment monitoring, reviews, and adjustments.

Conclusion

Portfolio diversification goes beyond just investing in precious metals- there are many ways to reduce risk and protect wealth while still leaving good opportunities for growth. This strategy is not infallible and requires a lot of monitoring and attention to keep things in good shape- but it is undoubtedly a smart tactic to use for long-term investment purposes.